A new report from EY reveals that nearly nine in 10 (86%) financial controllers expect their roles to change dramatically by 2030, with 39% anticipating a heightened focus on value creation—actively supporting business growth—along with value protection and optimization.

The thing is, most controllers aren’t exactly sure how their job will change in the coming years, according to the 2024 EY DNA of the Financial Controller Report. The survey gauged the views of more than 1,000 financial controllers across 28 countries and territories.

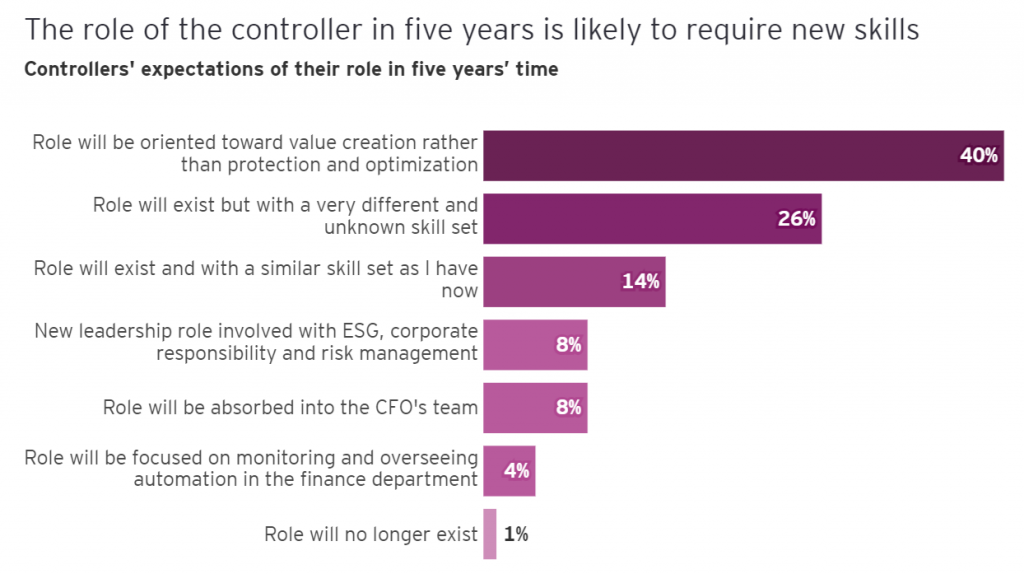

More than a quarter (26%) of controllers surveyed expect their roles to demand completely different—and perhaps even “unknown”—skills by the end of the decade. Only 14% say their future role will be similar to what they’re doing today.

“The role of the financial controller is on the cusp of significant change, and while it is not clear exactly how this will play out, it is evident that financial controllers must now deliver at a high level on multiple challenges at once. They need to strike a balance between delivering short-term performance and enabling long-term value, and their responsibilities now stretch far beyond the balance sheet,” Myles Corson, EY Global and EY Americas strategy and markets leader, Financial Accounting Advisory Services, said in a statement. “With the right level of support, however, there is a huge opportunity to shape the role and transform the function so that it can look to the future with confidence.”

According to EY, financial controllers are ready for whatever changes await. They are ahead of most finance leaders in relation to the growth of artificial intelligence, with 67% already using the technology for daily tasks. In addition, a majority of controllers (88%) are using data to provide strategic insights—something that AI is expected to improve.

However, many are not getting the support they say they need to help them become value creators. One in 10 (10%) say they don’t have the necessary staff and a fifth (20%) report that they lack the required budgets, according to the survey.

In addition, controllers aren’t universally focused on the areas for future development. Just two-fifths (43%) say innovation should be a critical aspect of the role, putting them at odds with more senior leadership, 51% of whom say it’s important.

The survey also suggests that more support may be needed to fully harness the power of emerging technology. Only 21% of respondents ranked searching for opportunities to use technology as one of the top three ways of creating value, while 73% cited driving company growth—suggesting that many are overlooking the capacity of technology to fuel growth.

Even though many financial controllers see value creation as the future focus of their role, a large group of respondents say they remain focused for now on value optimization, such as cost-saving strategies (46%), rather than on seeking out opportunities for growth.

However, the survey did identify a set of financial controllers (25% of the overall sample), known as “confident controllers,” who are already driving value creation through technology. Nearly two-fifths of this group (37%) lead on innovation, compared to 25% of other controllers surveyed, EY said.

The survey also points to a potential talent shortage at the top of the profession over the coming years, with just a third (32%) of confident controllers saying they want to become CFOs.

Interestingly, those with CFO ambitions are often less convinced about the importance of some business areas than controllers who want to remain in the role. For example, 73% of controllers who want to stay in their positions say innovation matters, compared to just 51% of those who aspire to be CFOs.

“The first step in any successful transformation is building recognition of the need for change. While it is clear this exists within most finance functions, financial controllers need to actively lead in developing the technological skills and knowledge needed to unlock their value-creating potential and enhance the brand of controllership with their leaders,” Corson said. “The divergence between ‘confident controllers’ and their peers when it comes to innovation, particularly their use of tech and data, is stark. These leaders provide the ideal model for less seasoned controllers to work toward in terms of skills and focus, and with the right support and approach, they can show how the role of the financial controller can be a force for true value creation and innovation.”

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs